Build a Moat or Build a Castle: Million Dollar Question

Do not decide using tools used for analyzing listed investments. Decide based on startup development

The vocabulary of ‘economic moats’ is borrowed from value investors who invest in publicly traded or mature privately held companies. It is a concept attributed to Warren Buffet and Charlie Munger and is an aspect of their investing approach.

Established businesses have financials. Their future performance is unlikely to be vastly different from the past unless disruption causes the underlying economic model to change. A competitive advantage should reflect in their performance financials. A firm that has not yet demonstrated the ability to earn an excess economic return does not change substantially without a positive change in the underlying business economics.

Therefore, the listed companies’ investment analysis involves identifying a company in an industry that has demonstrated good capital returns. Then, identifying its competitive advantage to discover why the company has been able to fend off competitors and generate excess economic returns. A company might not have a ‘moat’ if there is no identifiable reason why the returns will persist into the future. Returns can be a consequence of structural advantages a firm has (An oil refining company located in the Middle East that sits on top of an oilfield).

This requires applying tools for competitive analysis.

- Does the company have a brand?

- Patents?

- Is it hard for customers to switch to competing products?

- Does it have sustainably lower costs?

- Does it benefit from network economics? (In a digital age, every firm has the possibility of creating network effects).

- Is it subject to technological disruption or a shift in industry dynamics? Etc.

Then the only remaining question is the durability of competitive advantage. And this is a subjective call

The million-dollar question — thinking of moats while building a castle?

Do startups create economic moats, or they occur naturally or by accident?

I suspect moats happen by accident.

As a startup founder, my primary focus was on working with customers to iron out the kinks in my product. It was difficult for me to think about ‘digging a moat’ while ‘building a castle.’ A moat could wait.

I hazard a guess that startups may not consciously create moats when they start. Moats happen naturally or even accidentally. Many things in a startup journey happen because unforeseen opportunities arise, and entrepreneurs change direction (pivot in managerial metaphor). Their initial job is to acquire and keep customers happy and engaged by improving their product and value proposition. And then grow the team to scale by winning more customers.

A startup is small and does not have a scale, so an economic moat associated with economies of scale is impossible. When I started, I created lots of granular knowledge, what experts call tacit knowledge, reworking all my assumptions while deeply engaged with customers, observing them, learning, and tweaking my product.

I did nothing to avoid competition. Maybe those who saw what I was doing experienced ‘The Innovators Dilemma,’ the term Clayton Christenson identified as a mindset/mental model rigidity when incumbents see innovation happening.

Startups are uncertain. As an entrepreneur, fear and hope were my constant companions. Fear that my product may be unsuccessful, will my team deliver, and will I have the capital to scale to breakeven before running out of cash? The hope and resolve driving my work are that I will create something new. Vison could wait. Fear and uncertainty are positive emotions. It makes a person more intense, determined and committed to the tasks at hand. The same uncertainty probably protects startups from the entry of well-funded competitors. Is competitive hesitation a moat, albeit a tenuous moat?

Do early-stage investors look for moats when they evaluate startups?

For seed and angel rounds of investments in startups, the founding team remains the most critical criteria, followed by market size and traction.

Investors who have domain expertise do have a lingering question in the background. Whether based on the work done, does the founding team show a mindset, how they have defined the problem and the solution, their technology use, and how they are creating the business, will enduring moats get made?

A startup always has a head start/momentum based on tech and business model innovation. The founders must exploit this advantage. They do consciously or otherwise. The influence of the founder’s mindset outweighs every other evaluation criterion.

Maybe this is how moats get created.

Innovation — how it begins

Startups begin with a product and/or service innovation/invention.

Adoption — the seed of growth

An entrepreneur uses technology, creates a product, and convinces a few customers to take a risk with them.

The entrepreneur focuses on continuously adapting products/services to early-adopter user needs, making customers loyal, increasing product use.

As the startup acquires more customers, adopting the new product is easier and faster, showing growth readiness.

Growth, lock-in, and data

When a startup decides how to engage with customers, customer engagement is best engineered using knowledge-based digital communities. These have characteristics of social/media platforms that enable customers to access, engage, collaborate, and innovate with the startup anytime, anywhere.

This is when customers feel valued, become committed, and lock-in happens. Lock-in is a handcuff. Customer commitment is a better term.

Customers incur tangible and intangible switching costs when they shift to a new product that causes buyer hesitation to shift (lock-in).

- Learning costs — Re-learning customer staff need to use the new product to accomplish the tasks they were doing earlier.

- Technology compatibility can make it difficult and expensive to switch between products.

- Cognitive uncertainty customers feel they will have to overcome when they switch from one product to another.

- Direct and indirect transaction costs that customers bear when they switch.

Demand creation and customer acquisition capability

The demand creation and customer acquisition capabilities based on treating customers as annuities and ‘Cost of Acquiring Customers’ as an investment with a return are intangible capability assets of a startup not reflected in the books.

Customer communities and network effects

Digital communities lay the groundwork of potential network effects, one of the most valuable moats. The classic construct of network effect is when the product/service value increases with each additional user. This is the benchmark for every startup.

Network effects do not happen on their own. They are engineered, using innovation, speed of growth, and adding value to customers beyond the transaction.

A network effect occurs when a good or service value increases for both new and existing users as more customers use that good or service.

- One-sided network effects occur when increased usage leads explicitly to improved welfare for the members of the network. The digital community is a foundation to create network effects.

- Indirect network effects occur when the increase of network members leads to increased creation of complementary goods and services so that the network’s members’ welfare increases significantly. Can the community platform lend itself to creative use, to add value? Can users become creators?

- A two-sided network effect occurs when an increase in usage of the product by one group of network members increases the welfare of a separate and distinct group of other members of the same network, exemplified by marketplaces like Etsy, Uber, and Amazon. Here to the community platform used creatively may create two-sided network effects.

Customer communities and network effects

In the age of AI and data, investors like companies have a path to create a data network effect in the foreseeable future. Data moats enable companies to derive meaningful insights they can use to better serve their customers, enhance their product offering, and create even more lock-in through a positive virtuous cycle. And as the flywheel accelerates, it creates substantial value. One factor to building a data-moat is that a startup must generate data and extracting insights from that data for predictive decision making and improving the value offering.

Patience in building a startup organization

Early-stage investors work on the belief that ‘All overnight success takes about ten years.’

A business moat created in engagement with consumers using data is an intangible resource that takes time to deliver economic value. Why?

- It is a knowledge-based resource, not easily replicable and transferable.

- It is an outcome of the accumulation of knowledge, a result of numerous experiments with customers. The data gathered acquires a predictive capability.

- Creating it needs investment in people whose work shows results after 24–36 months.

- And requires a unique (hate to say different) organization DNA. A lot easier for a startup to manage. Legacy organizations struggle with changing their working; delegation of decision making, lean experimentation, and tolerance of learning through failure).

When is branding justifiable?

Startups first create a product that acquires sustained trial and adoption by customers/users. Paid customer acquisition occurs after organic customer acquisition is established. In the initial months, a startup needs to behave like a media company creating lots of content to assess customer responsiveness. Paid acquisition is a rabbit hole of early capital. Brand building is a customer acquisition tool with an ROI.

Management actions

Early-stage startup founders excite investors when they demonstrate that they know what it takes to build an organization that will become valuable.

During the pitch, investors make assumptions about the founders:

1. How much do they know about how customers buy?

2. What they believe are drivers of the industry?

3. What core assets are they acquiring / building?

4. How will the organization be structured based on vacant positions?

These questions, the founding team’s collective thinking/mindset, determine how raised capital will be used. Actions speak louder than words.

1. What is capital allocation?

2. Does it manifest the allocation priorities of the founding team?

3. Do the priorities correlate with their strategic priorities of capability building?

4. The team is not taking short term actions to show results.

At the early seed stage, the focus is on the product at the seed stage and then shift towards building capabilities of data capture and analysis, essentially longer-term plays.

Why this article skews towards technology networks and communities of customers?

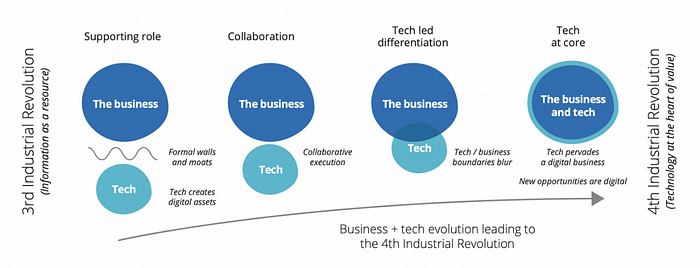

The following image summarizes my thinking about the role of technology in startups (and business). All businesses are technology businesses.