The meaning of unit economics for startups and investors.

What is Unit Economics and why is it important for Early-Stage startups (and established companies)?

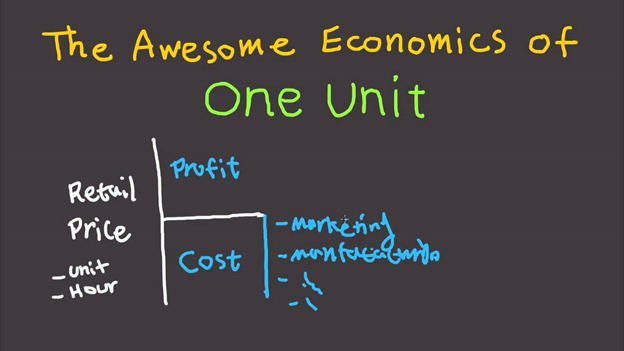

Why am I writing this? Because as entrepreneurs (and managers), we need to understand what unit economics tells us about the underlying business model and how it can guide us in making important decisions with strategic implications. And this requires balancing three different perspectives (identified in the image below) — should the focus be on gross margin (% or total), or track total revenue and total costs, to manage incremental revenue and incremental cost?

Gross Margin %

Gross margin (%) is a measure of profitability. It only shows the percentage of revenue that exceeds the cost of goods sold (COGS). The gross margin (%) reflects how successful a company is in generating revenue (unit selling price X units) at a point in time, considering the costs involved in producing their products and services. (For a clean analysis of margins ensure that no variable COGS have been shifted into operational costs inflating the Gross Margin %, an error that can happen during a startup creation journey or be a legacy of lax accounting standards).

A CEO who exclusively focuses and relies on Gross Margins (%) is a legacy of a pre-digital era, influenced by a trading mindset. For them, Gross Margins (%) translated into cashflow endowing their business (and them) with an ability to invest in growth, product development, innovation, and creating customer stickiness. High Gross Margin (%) is not indicative of a ‘good’ business.

Impact of units sold.

Low margin businesses can have excellent cash flow. I once implemented strategic price tiers, reducing Gross Margin by 2% (from 65% to 63%). This resulted in a 29% increase in units sold.

The P&L statement analysis is based on Gross Margin ($). Units sold impact the ‘real’ cashflow.

Business quality

Business quality is a function of more than margins; it is about business defensibility and how difficult it is for a competitor to ‘bridge the moat and ‘breach the fortress.’ Externally funded startups focus on building a customer acquisition capability (growth) and compromise margin in the initial years. A high margin business gives headroom for startups to enter (disrupt by investing capital) and innovate (monetize) when a scale/market share is achieved.

For a startup, unit economics (gross margin analysis as a % analysis of costs (not sales)) is a better measure though still an unsatisfactory indicator. An analysis of how the revenue and cost are behaving, do the cost and revenue curves show that unit margin is improving?

Revenue cost curves versus gross margin

A business can have the best margins but needs to manage costs to be successful.

The slope of the total revenue curve (TR in the diagram) must be steeper than the total cost curve (TC in the curves). The total cost rising faster than the total revenue (Figure on the right) will kill the business.

Gross margin, total revenue, and total cost are not enough to understand what is going on in a business.

Connecting revenue, expenditure, and the margin is the best first measure of a business's efficiency.

This is done by plotting marginal revenue and marginal cost curves. Marginal cost is the change in total cost divided by the change in output. Marginal revenue is the additional revenue that will be generated by increasing product sales by one unit.

In the image, incremental cost curves decline (economies of scale) and then rise.

As an executive, I will keep selling if I ‘earn more’ in a sale (my incremental (marginal) revenue is greater than the incremental (marginal) cost. This is because the firm will continue to produce until marginal profit is equal to zero, and marginal profit equals the marginal revenue (MR) minus the marginal cost (MC).

Suppose Marginal Cost (cost of making 1 more unit) is rising faster than Marginal Revenue (revenue made by selling an additional unit, a company is making less Gross Margin ($) for the additional unit. If marginal revenue is rising faster than marginal cost, many decision options are available — if market space exists, focus on customer acquisition (without price change) or capture market share by tweaking prices.

Marginal Revenue and Marginal Cost have a different meaning for startups.

The same curves for a startup have a different meaning. The Marginal Revenue and Marginal Cost graphs indicate whether the economies of scale are kicking in (is marginal revenue is rising faster than marginal cost). If this is indeed so, an entrepreneur can begin to focus on growth by investing in demand creation and customer acquisition. In a late-stage startup, the Marginal Revenue and Marginal Cost graphs tell us whether economies of scale have been reaped and marginal cost could be rising faster than marginal revenue.

Economies of scale, the behavior of the cost curve, and the dangers of paid customer acquisition. This is something investors need to watch out for.

Economies of scale is the cost advantage resulting from increased business scale; the business creates higher value as the cost curve steadily declines and the selling price is maintained. A test of economies of scale — per unit costs is improving without degrading unit economics. Unit economics needs to be dissected, analyzed carefully, attention given to whether paid advertising is driving high volume and scale benefits. Paid marketing can be excessive, making the scale effects unsustainable; sales units can dip if paid marketing is reduced, making unit economics unprofitable. However, if organic customer traffic is sustained, it compensates for paid traffic decline, customer acquisition cost curves declining.

The cost and revenue curves tell us where a startup is on the valley of death curve and decide whether or not to accelerate growth by deploying cash (raising cash, if necessary).

Marginal cost and marginal revenue are not enough to understand what is going on in a digital business.

A digital business behaves differently.

For digital products, the marginal cost decreases indefinitely. A SAAS or eCommerce platform, once built, can theoretically serve many customers. Making more and more copies is easy.

And margin revenue can increase indefinitely.

A traditional goods business continues to sell well until the incremental revenue offsets the cost.

A digital business, where incremental cost is negligible, has an incentive to keep reducing prices to acquire users/customers.

If the prices really can go to zero, then companies must discover ways to create revenue in a perpetually declining price market. We have all experienced the following pricing strategies. Their roots lie in the perpetually declining/extremely low marginal cost.

1. Make the product free to use. Free is a customer acquisition strategy. Product fits in an ecosystem of many services. The free product makes a bigger set of products more valuable or makes the customer sticky. The free product cost is a cost of customer acquisition and economically worth it for the business.

2. Bundle the product. Create a bouquet of products. Each is a low marginal cost item, but the bundle value is perceived as worth paying for. Amazon Prime Video mixes delivery and movies, creating a recurring revenue stream.

3. Freemium + tiered pricing. The core product, within limits, is free. Once a customer experiences the value proposition, it is expected that they will graduate towards higher tiers with more features.

4. Price the product at a level it feels extremely low. Phone Apps are priced like this.

Questions for startups

Startups must first discover the price.

Can you charge a price premium?

Product is attracting customers.

Does the product/service have a natural pull (traction) to reduce marketing costs?

Embeddedness

Can the product be embedded in the user organization process or a user’s life? Embeddedness influences customer stickiness. They do not search for alternatives.

Differentiated offering

A question to answer is — is the digital product differentiated in the eyes of customers?

Today's features, integrations with other Apps, reportability of information, etc., the features of a product are reproducible, the experience, ease of using the product, is more difficult. Startups need to focus on differentiating the product and service in a way that matters. If you are likely selling a differentiated offering, then you have pricing power with the customer. Are customers willing to pay a higher price for your product than others? When you spend time with customers and say no one can match your offering, they will willingly pay a premium.

Network effects

My first experience with Network Effects was when I was strategizing for Tim Hortons growth in the Gulf. The store density in geography is based on a ‘store network effect’ — if store density in geography, stores per population, reaches a threshold, the sale of the entire fleet of stores gets an uplift. This effect is driven by the customers integrating the brand (in the case of Tims, a low-priced product, visible everywhere and easy to access in a market of many undifferentiated options).

Network effects in a digital world happen when a product or service becomes more valuable to its users as more people use it, creating a flywheel effect on growth. This impacts organic growth (cost of customer acquisition declines), increases switching costs (customers become hesitant to switch), and becomes an engine to build a scaled business.

Higher consumer engagement with a product and increasing spends by each user is a potential indicator of the beginning of network effects.

Engagement metrics

The % of daily active users to the monthly active users is increasing — more users are coming every month, and more of the monthly users are using the product/service every day.

Monetization metric

Is the revenue per user increasing organically?

Growth in users

The cost of customer acquisition is declining as the number of new users is increasing. Existing users are attracting new users.

Brand power

How does one know if they have a powerful brand?

Increasing organic and direct traffic. An increasing percentage of traffic and revenue is coming from organic or direct channels (vs. paid).

Decreasing customer acquisition costs (CAC). CAC, the marginal cost to acquire each new customer falling or staying flat. Increasing organic and decreasing CAC.